On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (PPPFA) in order to address many concerns by the small business community. Here are a few highlights of the changes made.

- PPPFA changes minimum requirement needed for payroll to 60%

This amount was originally required to be at least 75% of the expenditures in order to qualify for forgiveness. For many businesses, this was very difficult to achieve because they were not able to operate. By reducing the amount of the loan needed to be spent on payroll from 75% to 60%, the amount of funds that can be used for other expenses was able to increase from 25% to 40%. The law does not change the list of expenses eligible for forgiveness. These still include: rent, mortgage payments, utilities and interest on loans.

- PPPFA extends time period to use funds from 8 to 24 weeks

For businesses shut down by government mandate, the ability to spend the PPP funds within 8 weeks was almost impossible. This should allow the forgiveness to be more easily achieved because the loan amount was based on 2.5 months of 2019 payroll or about 10 weeks. Individual employee compensation eligible for forgiveness is still capped at $15,385. The extension of time allows flexibility for business owners to spend the loan after reopening but does not require businesses to wait the full 24 weeks to apply for forgiveness. They can apply for forgiveness after 8 weeks if they prefer.

- PPPFA pushes back June 30 deadline to rehire workers to December 31, 2020

In the initial PPP instructions for forgiveness, employers were to maintain their employee headcount or restore headcounts by June 30th in order to achieve full loan forgiveness. Many businesses were concerned that this may prove to be difficult because they may not be open or if they have reopened, they may be functioning at less than full capacity by this date. The salary forgiveness calculations have still remained the same.

- PPPFA eases rehire requirements

As the intent of PPP was to keep the same number of employees on the payroll as was used to calculate the loan, it required a business to rehire the same number of full-time employees or full-time equivalents by June 30, 2020. The only exception to this rule was if an employer could document in writing an attempt to rehire an employee who rejected this offer.

The new law makes two significant changes to these requirements. First, it extends the rehire date to December 31, 2020, and second, it adds additional exceptions for a reduced head count. The law states a business can still receive forgiveness on payroll amounts if it:

- Is unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020;

- Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020; or

- Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.

It remains unclear how to “demonstrate the inability to rehire similarly qualified employees” or what the standard “to demonstrate the inability to return to previous levels of business activity” would be, but hopefully forthcoming guidance will elaborate.

- PPPFA extends the repayment term from 2 years to 5

Businesses will now have 5 years to repay the loan at 1% interest instead of the 2 years initially expected. The first payment will also be deferred for six months after the SBA makes a determination on forgiveness. Since under current regulations your bank has 60 days to make a forgiveness determination and the SBA an additional 90 days. The timing on requesting loan forgiveness can have a big impact on the financial health of your business.

- PPPFA allows for Social Security tax deferment

In addition, the PPPFA also allows borrowers to take advantage of the CARES Act provision allowing deferment of the employer’s payroll taxes for Social Security. Previously, PPP did not permit deferment of these taxes on the forgivable portion of the loan.

In Summary

The new law changes are a win for small businesses and address many concerns and ease the requirements in order to achieve full PPP loan forgiveness, but as we have seen over the last few months, we can expect more information to come. Let us know if you have any questions about your PPP application, forgiveness or accounting strategy throughout this process. Call us at 281-440-6279!

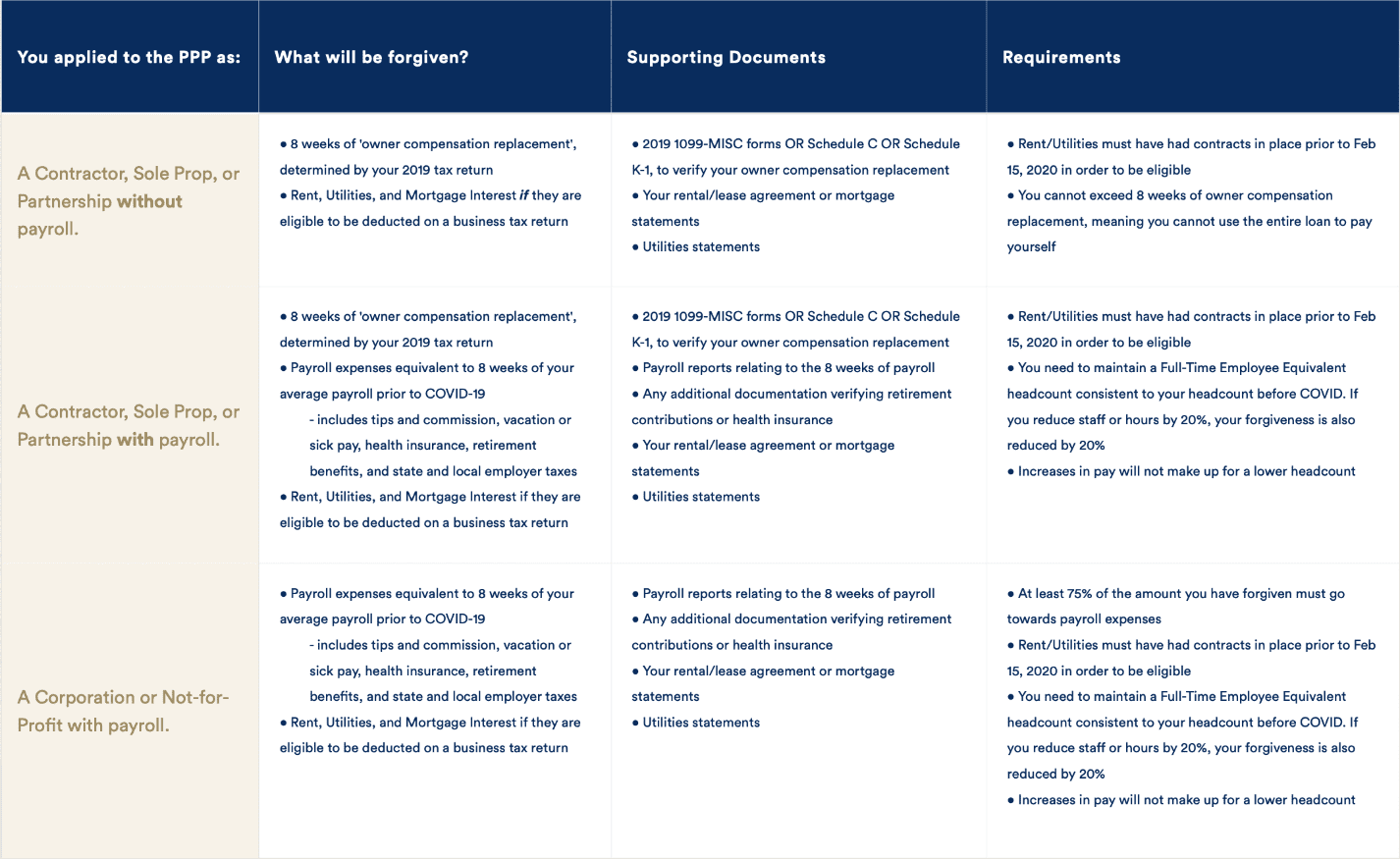

How can I get my PPP forgiven?

On May 18, 2020 the SBA released the official form you will need to fill out in order to apply for forgiveness on your PPP loan. Hopefully you are tracking all of your expenses and can show very clearly what has been paid and when. Even if you do not get the entire loan forgiven, this does not mean you now have to pay back 100%. You can be partially forgiven.

What documents are needed for PPP forgiveness?

While each scenario, lender and small business are different, here is a basic list of items from the approved uses list that you may need to provide:

- Documentation verifying the number of employees on payroll and pay rates—including IRS payroll tax filings and state income, payroll, and unemployment insurance filings

- Documentation verifying payments on covered mortgage obligations, lease obligations, and utilities

- Certification from an authorized business representative that the documentation provided about the small business is true and that the amount being forgiven was used in accordance with the program’s established guidelines

Is PPP still available? How long will PPP funds last?

The initial round of funding for the PPP ran out of cash in 13 days. Now that a second round of funding was passed, the SBA has distributed $510 billion of the $659 billion allocated to the PPP as of June 5th. This means that less than $149 billion remains. and has probably saved as much as 50 million jobs” by requiring employers to rehire laid-off and furloughed workers in order to receive loan forgiveness.

Recent Comments